Recap of the “Business as Romance” Presentation

It is great to see you again, my friends. Just as a refresher, last month we talked about the importance of marketing based on psychology, based on how humans think, operate and build relationships, because that helps you avoid falling into different marketing fads like “Ten Ways to Beat Google”, for example. Fads like these will very quickly run their course. We also talked about how crafting an actual marketing strategy is not just a marketing department function. Every element of your business and brand that your clients or potential clients engage is marketing. So we discussed whether an online business should create a storefront or vice versa. We asked what should your pricing be? We talked about what your customer care people say on the phone when a prospect calls in. All of that is marketing. We also discussed the importance of frequency in marketing – we must have enough frequency to remain top of mind. And lastly, we talked about how our words matter when we’re engaging with people whom we want to develop a relationship with, whether that’s in our personal lives or in our professional lives.

Acting out of Panic in Times of Uncertainty

So, my friends, today we are going to be talking about marketing when times are lean. Anyone kind of feeling the pinch right now? Anyone a little worried about how much worse the pinch is going to get? That’s exactly what we’re talking about today.

So if you rewind about 24 years or so, I found myself in the deep end of a swimming pool, flailing, trying to get to the surface. And I was just absolutely panicked. What’s interesting is, I was pushed in, but I knew how to swim. Yet I still found myself flailing. See, swimming for me would have been effectively using the resources and skills at my disposal. But because I was in such a panicked state, I was sinking lower and lower and lower. Now don’t worry, I survived. But even as adults, we often find ourselves flailing in unexpected situations.

Think of, for example, the stock market. Anyone who invests in the stock market has probably heard the rule of thumb, “Buy low, Sell high”. However, what often happens when those of us who own stocks find that the economy is tanking and the stock market is going down? The thought process is often, “Okay, I need to sell right now before it gets any lower and I end up selling at a huge loss”. Or on the flip side, we get super excited when we see the stock market taking off and we want to get in while the getting’s good. So we end up buying high.

See, when we allow panic of our current situations to cloud our judgment, it can lead to very bad outcomes. By the same token, when we’re in a time of uncertainty or economic tightness for our businesses, we can do either the efficient thing or we can act out of panic. And having worked with many, many business owners, the default is always panic.

We ask ourselves, “what can I do?”, and in this context, “how much cash can I keep in reserves? What can I cut out?”.

For me, this is personal. Many years ago, I started a business that ultimately had to close its doors because of just this thing. I decided I needed to play small amidst an unsure economic future and ended up needing to close the doors because of this decision. I then spent the next significant period of time, as I began consulting with other business owners, trying to figure out what they need to be focusing on so that instead of panicking and cutting everything out of their marketing budget they could use the resources that they had most efficiently. So that they could stay afloat. Because if our response in uncertainty is panic, we’re going to make foolish cuts.

It plays out like this:

We fear the economy and the future of our business. So what’s the natural response?

We cut the marketing budget. What’s the implication of that?

We have lower revenue down the line. So then what?

We reduce the marketing budget even more… so we have significantly lower revenue, and it ends up being an endless death spiral until the company eventually goes out of business. Or maybe if the turbulence doesn’t last too long, you’ll make it through.

But here’s the other challenge: Marketing – building a relationship with people – is all about momentum. So whatever marketing you’re doing right now, you are building momentum and relationship equity with your potential clients. And if you bring that momentum to a screeching halt, you’re going to have to exert a lot of effort to get it started back up again, just like pushing a car.

The Point of Diminishing Returns

So what we’re going to talk about today is how to, instead of cutting out all of your marketing to try to preserve your company, how can you use your marketing budget more efficiently to help you not only weather the economic storm we’re in, but also excel into the future?

So we’re going to start with this graph on media effectiveness vs. media spend. I found this really interesting as I began my research into how to efficiently use marketing. Often, when I connect with business owners, I ask the question, “What kind of marketing are you doing?” And they proceed to list out a whole rap sheet. “Oh, we’re on Instagram, we’re on Facebook, we’re on TikTok, we’re on Pinterest. Also, we do some TV, a little bit of radio, some print ads, some banner ads, Google ads, etc…”

That’s a lot, especially for small business owners. How do you manage all of that? How do you do that effectively? Also, that’s probably costing you a lot of money or at least a significant amount of time. Are there any business owners out there who want more time in their schedule? Do you have things that you could be doing if you didn’t have to spend a whole bunch of time managing a bajillion different marketing channels?

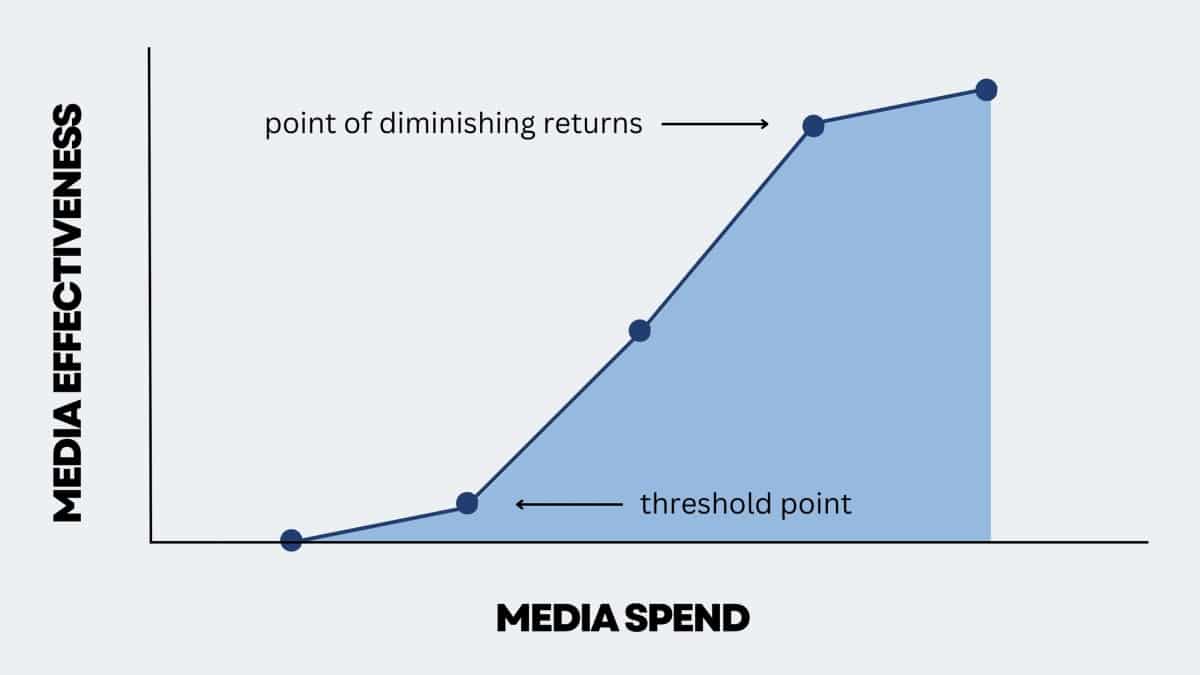

So what the researchers, Les Binet and Peter Fields, who focus on marketing effectiveness found after researching tens of thousands of businesses is this… I’ll start with the X axis. The X axis is media effectiveness. We’ll define that as: how much are you spending on marketing versus how much revenue you are getting back from it. So in the ideal situation, you want to spend the least amount possible and get the most return. That’s marketing effectiveness or media effectiveness. Then on the Y axis, you have your media spend. So that’s how much you are investing in a given type of marketing, whether that’s TV, radio, fill in the blank. What they found was quite fascinating. Before this, I would have assumed that it would be more of a diagonal straight line where the more that you invest, the more outcome you get, and it’s probably in a similar proportion. But what they found was with every form of marketing, there is a threshold point, and that’s this little dot toward the bottom. Before you get to that threshold point, you are investing a significant amount into that marketing channel and you’re frankly not seeing much from it. But once you invest beyond that threshold point, all of a sudden the ROI starts taking off and you get a disproportionate amount of revenue off of the dollars that you’re investing in that media.

It’s fascinating. Additionally, they found that with every media channel, there is a point of diminishing return. So as you invest heavily into a specific type of marketing, there comes a point where it doesn’t make much sense to continue increasing your investment. You’re just not going to get the value that you would if you, for example, started marketing in a different channel.

So to bring these research findings home, a lot of small businesses or medium sized businesses assume they have to be marketing everywhere. “Wherever the customer is, that’s where I need to be.” The problem is you’re not going to be able to invest enough money in all of those channels to be able to get beyond that threshold point where you actually begin experiencing a good ROI. So I am giving you permission to as you go back to the office this afternoon, to map out all of the different means by which you are marketing. And begin just cutting some of them out. I’m not saying to do this haphazardly, but I’m saying it is far, far better to focus on a few channels and do them really well then to focus on all of the channels but only go an inch deep. You will get significantly more bang for your buck.

And for the larger business owners out there, it’s important to recognize your point of diminishing returns. It may be time to diversify into other forms of marketing if your ROI is not increasing with your media spend anymore. We’ll have a time for Q&A afterwards, so if you have any questions on this or anything else we talk about, you can write them down now and we’ll make sure that we get to them.

Brand Building vs. Sales Activation

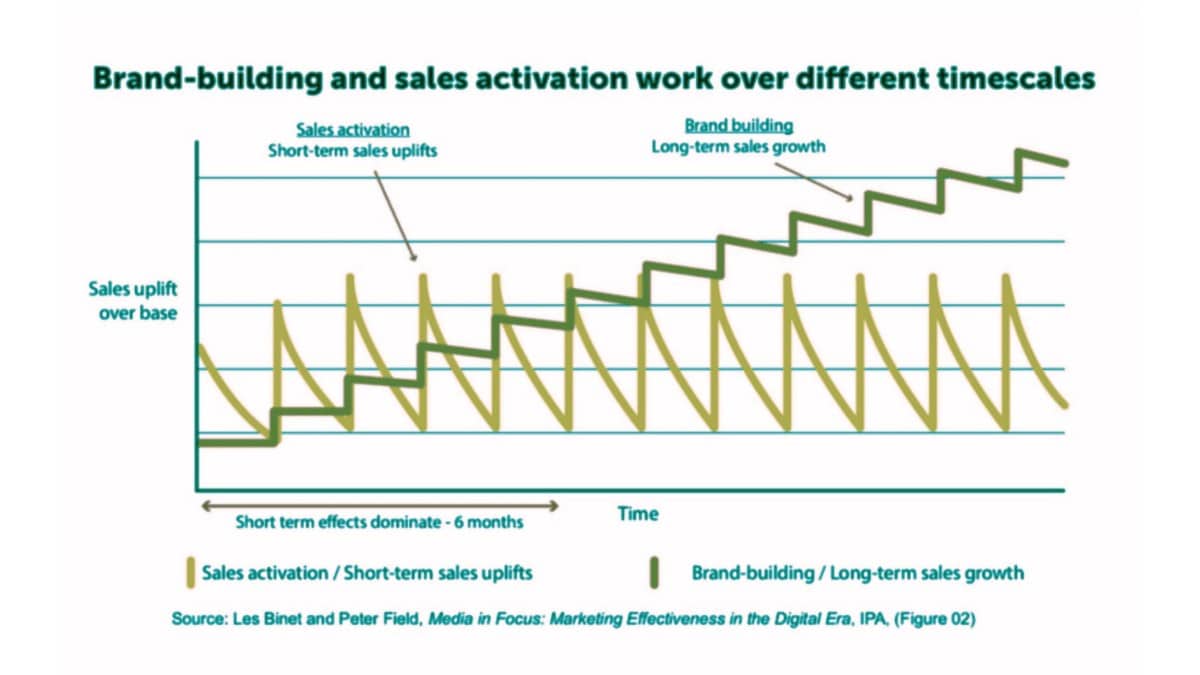

Another interesting thing we talked about last month was brand building versus sales activation. At any given point, it’s fairly safe to assume that around 5% of potential customers for your business are in-market right now. The other 95% will eventually be, but they’re not in buying mode now. So often the business owners we talk to are so focused on digital marketing, which is frankly a great, albeit expensive, mechanism to capture those 5% in-market. But they kind of ignore building relationships with the other 95%. So what you’ll see again on the X axis of this graph, you have sales uplift over base. Base means whatever your revenue is right now. Then the Y axis is progression over time. So what’s interesting about this, if you look at the yellow line and I know it’s a little bit faded, but the yellow line is sales activation.

Sales Activations includes things like running a promotion: “Come in this Mother’s Day, because we have 50% off everything” or Google ads, pay per click, and anything that’s trying to capture the sale right now. So as you’ll see when you do sales activation, it creates a spike in your sales uplift over base. That spike eventually loses steam, though.

What you’ll find with the greenish line, however, is the effect of brand building. That’s what we talked about last month. And if you’re interested, I can send you the recording for the conversation last month. But with brand building, you’ll notice you really don’t see much lift from where your revenue is at right now until around the six month mark. But it’s compounding interest. So point number two for today is know what you are investing in. Just like with a personal financial investment, if you invest money into your savings account, it’s readily accessible. You’ll get negligible return. But is there a difference between that, investing in stocks, or investing in a 15 year Treasury note? Yes, there’s a difference both in the expected investment and in the duration of time in which you could or should pull it out. By the same token, if you are investing in sales activation marketing, it’s going to have a different time horizon, but it’s also going to have a different amount of overall return on investment.

So my encouragement for you would be to consider shifting some of your sales activation budget over toward branding, over toward relationship building with your clients. I’m telling you ahead of time, in the short term you will see a drop in revenue from your base. But if you do relationship or brand building well, it’ll begin building like a snowball.

Let’s go back. I want to talk for a minute about pay per click. A lot of companies use pay per click. Pay per click was wonderful back when Google first rolled it out. And for a couple of pennies, you could get someone who was in the zone to buy right now. My partners and I sometimes recommend pay per click. We actually quite often do. But it has to work for you instead of, frankly, you working for Google. We refer to it affectionately as pay per “crack” because it very much is like a slot machine. Just picture this. Okay? If I put $100 into pay per click, what am I going to get out? Oh, out of the ten people that clicked on it, three of them just wanted my customer care number, four of them converted and the other one who knows where they went? Okay, well, we got a couple of them. Let’s try it again.

It’s just very much an addictive cycle, which is part of why so many people swear by it. Again, I’m not against pay per click. However, when you have business owners who are repeatedly paying $800 per click or more, it’s like, hold up, there’s a time and a place for pay per click. Google operates on a bid method where the more people who are trying to get those words, the more expensive it’s going to be. Therefore, if you’re in a really tight marketplace, it is extra important that you focus on brand building because you’re going to be paying a ridiculously high customer acquisition cost if you’re primarily leaning on pay per click. I’m trying to save you guys as much money as possible because there’s a lot of really expensive ways to get leads.

Next, we’re going to talk about targeting. There’s nothing per se wrong with targeting. Targeting used to be, you know, hey, I have a list of 60 people who are in the market to buy. They’re your ideal client. If you’ve mapped that out, this is them. That was a great thing when it first came out. In some contexts. But here’s the thing with relationship based marketing, it’s so often significantly less expensive than the hyper-targeted or over-targeted list that you’ll find. And so while someone will brag about having 60 ideal potential customers for you, it’s like, okay, I can use relationship marketing to reach those 60 people and 600 other people. And all of those 600 people also have people that would be potential customers. And if we’re focused on building relationship, whether they’re buyers or not, it creates a natural marketing snowball. For example, if someone were to build relationship with me, even if they sell something that I’m not particularly interested in right now, like, figuring out a retirement home, I may not be interested right now, but if they build a relationship with me, you better believe I’m going to recommend my parents at least check them out.

So we can focus so much on paying top dollar for an over-targeted list when oftentimes with mass market products or services, we’d be much better served by spending less on building relationships with more people than by honing in and crossing our fingers that the few people on the list buy. Which most of those lists are trash, by the way. We just need to be very mindful because that’s frankly what our goal is: creating efficiency. If there are areas in which we can reduce your marketing spend while increasing your ROI… Yes, please.

How Does Your Marketing Tie Into Your Sales Funnel?

Okay, on to number three. Who can define what a marketing or a sales funnel is?

Above is a visual example. At the top of the funnel is attention. Your goal is to connect with potential customers and help them realize that you exist, right? If they don’t know you exist, they’re probably not going to buy from you. I think we all could assume that, but there are a bajillion ways of doing this. We’ve listed off some, such as radio or billboards. There’s even in the digital world a lot of ways to help people know that you exist.

The next thing that the customer is going to be going through in this funnel is interest. “Why should I care?” “What are you going to offer me?”” What are you going to do that’s going to be worth me engaging with you?” Oftentimes this is where customers will begin doing research as they move into the decision phase.

In the decision phase, your customer has acknowledged that they should probably should buy what you offer. But there are frankly a lot of other businesses that do what you do. So how do they decide? Do they talk with their peers, talk with their family? Do they look up reviews on Yelp?

And then the final step is action. This is where they decide, yes, I’m going to not only buy this product or service, but I am going to buy it from this business owner.

Each of your marketing campaigns or marketing efforts must be able to tie into this funnel. If it does not tie into this funnel, you should not be wasting your money on it. So often business owners that I have talked to will create a marketing campaign on social media. And if you ask them why, it’s like, “because it’s cool”. Okay, maybe that could fall under the attention part of your funnel. But so often our marketing efforts don’t really tie into what the customer’s journey is. We have leaky funnels. Let’s say you have a social media campaign that you’re building out and when someone clicks on it, instead of landing on your product page, it directs them to your home page. Okay. If the ad has done all the work to get them to the bottom of the funnel and they want to buy, but you’re taking them to the home page, you’re potentially going to lose their interest. But the opposite is also true. All of our marketing must not only be tied into where the customer is going to be within the funnel, but also needs to direct them in the smoothest possible path down the funnel, reducing friction for them to ultimately do business with you.

Otherwise, there’s a lot of potential revenue that we’re just straight up missing out on. Again, we’re all about creating efficiency and so often businesses are losing significant revenue just because, for example, their website’s not all that optimized for a customer journey. Now what you see up here is more like a funnel, right? In actuality, as you build it out and I would encourage all of you as you go back to your places of work this afternoon, map it out, create a funnel like this, and then create a lot of bubble examples of the types of marketing you are doing. Map out everything that you’re doing and draw a line to which part of the funnel that it connects to. You may find that there’s an entire tier that you’re missing, which means for more calculated buyers, if you don’t give them the resources to make a decision, they’re going to your competitors to get the information, to make a decision, and they may as well just buy from them while they’re at it.

Know Your Vendor’s Incentives + The Story of the Python

Now, number four and our final main point for today: It is imperative that we know what the employees we work with as well as the vendors that we work with are incentivized by.

Many years ago, I heard a story of a woman who lost her husband. Now, I can’t relate to this component of her life, but she loved reptiles. And so in the grieving process of her lost husband, she decided to acquire a baby python. Over the course of the next several months, she, in the absence of her husband, developed a really deep connection with this python and she decided she was going to let it sleep in the bed with her. And it was super cute because it would actually lay its head on the pillow next to her, just like her husband did. And it really helped her in the process of grieving. It would lay its head on the pillow and lengthen itself all the way out, just like her husband would have been laying. And she told her good friend that was very comforting to her. Around the six month mark, paramedics showed up at her house. Y’all are laughing, so you know what happened. But here’s the thing, she was convinced that the goal of the python, as silly as it may seem, was to be there for her and to connect with her. But really, it had ulterior motives the whole time. What they found doing the autopsy was that it was not stretching out to be there like her husband. It was instead stretching itself out to figure out how big it needed to be in order to eat her.

That was its incentive. Horribly gruesome. But I think it makes a point. And the reason I bring this up is so often the vendors that we hire to help our business, while they’re hired to help our business, their incentives do not align with what we need them to do. This can be any type of vendor, whether that’s in the legal world or even, as I mentioned, employees sometimes have incentives outside of what we would like them to do. I’m most familiar with the marketing world, so I’m going to focus on there. I swore up and down, to be completely honest with you, that I would never go into marketing. It is an industry filled with slime balls and weasels. Just to call it how it is. And so much of that comes down to the incentives that they have to grow their own revenue.

Does anyone know the primary thing that most marketing firms attach their revenue growth to? Your marketing budget.

So let’s play this out… You are marketing with them, they’re not quite getting the return on their investment they would like. They’re not getting the revenue numbers that you were hoping for. And so what do they do? They say you just need to increase the budget and you’ll reach more people and all will be well.

Question. How do you know whether the reason they’re saying to increase your budget is because it’s going to line their pocket or because it’s going to help your business?

Back to the original example of flailing. When we are in a state of panic, we tend to flail and potentially even do things that we wouldn’t otherwise do. But remember, our businesses are not the only ones who are potentially struggling. Marketing firms are too. You don’t want to be spending any more of your budget willy nilly, especially not lining their pocket, then you absolutely have to.

Additionally, many marketing firms gather around a 15% commission on every channel that they bring a client to. So what’s to keep them from just going to a bajillion different firms, a bajillion different marketing channels to try to capture as many different commissions as possible? And as we are talking about how to maximize your budget, if you’re investing in a whole bunch of these different channels, how likely are you to pass that threshold point? The entire incentive structure for frankly, most marketing firms and likely a lot of other type of vendors is at least providing a conflict of interest, more likely, in my opinion, is completely unethical.

I want to share a quick story with you. Not long ago, a company reached out to us. They’re a big company in the Midwest. They told us that 6 to 8 months ago they had started with a marketing firm that had recommended they invest about $80,000 per month in pay per click. Well my partners and I offer this service…it’s basically a look under the hood of your digital marketing service. And we give you an assessment on what you should look into. So we put our top digital guy on it and he’s like, “Yeah, I don’t know how you spend more than $40,000in pay per click… maybe. Anything beyond that is a complete waste of time. It’s past that point of diminishing returns.” And so we encouraged them to request access back from the digital marketing company to their accounts, and that marketing firm said no. So they took them to court and the business owner naturally won. But what they found when they looked under the hood was on top of the agency fees, on top of the upfront research and development fees, that marketing firm was pocketing $40,000 just straight into their pockets. That company ended up signing on with us. We said they should invest no more than $25,000, and they’re now threefold where they were two years ago.

And while this story is fairly big time, the same thing happens just as much on small scale.

Anyway, the reason I joined Wizard of Ads is there is only one incentive that business owners care about… growth. We only make more as you make more.

How much growth is your marketing firm getting you? Any incentive other than that is going to open the door for impropriety. The best way to protect yourself is to find people whose incentives align with yours. And this isn’t just digital marketing firms, this is a spouse, too. If you don’t have a spouse who aligns with you on the key things, it’s going to inhibit the relationship’s ability to go deep.

Recap and Final Thoughts

So today we’ve talked about:

Don’t stop pushing the car. Don’t just cut your marketing budget willy nilly. As I shared with you, I want you to spend as little on marketing as humanly possible. But if you cut it all out, you will lose all momentum and it will be incredibly difficult for you to rebuild the progress, the progress that you have made.

Only market in as many places as you can crush it. And remember what we learned about that threshold point.

Know your investments. Is the marketing that you’re investing in working toward a short term goal of capturing that 5% of the market ready to buy, but at a pretty high cost? Or are you also investing in building long-term relationships that will have compounding interest?

Patch the holes in your marketing and sales funnel. This is of vital importance to your business. Map it out and figure out how every aspect of your marketing budget is playing into your sales funnel.

Finally, factor the incentives of your vendors into the weight you give their advice. If you look at the StrengthsFinder personality assessment, my top strength is empathy, which is part of why I get so frustrated with marketing firms that have incentives that don’t align with your incentives as the business owner.

As always, if there is any way that I can help whatsoever, please don’t hesitate to reach out.

It’s been a pleasure connecting with you all.

- Which Marketing Strategy is Most Effective? - February 10, 2025

- How to Become Famous on a Small Marketing Budget - January 31, 2025

- Is ROAS the Crown Jewel of Marketing Metrics? - January 23, 2025