Abraham Maslow told us people have a hierarchy of needs. And once they satisfy those needs, they try to fulfill a new level of needs.

He didn’t tell us why they bought one brand over another within those needs.

Adam Smith believed each individual tended to his own gain. Everyone strives to become wealthy. He believed that the lower-priced item would always outsell the higher-priced item if both were readily available.

Mr. Smith figured out when two items were perceived to be the same, the customer would choose the lower-priced item. He didn’t discuss customer value.

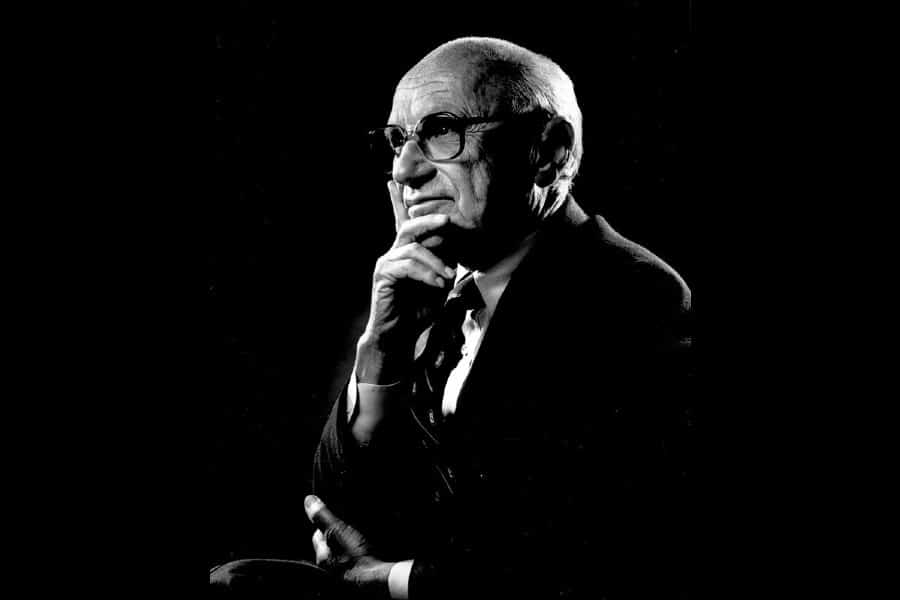

Milton Friedman, a Smith advocate, postulated the sole reason for a company to exist is to maximize shareholder value.

Friedman is a hero to the investors who wanted to make more money. He’s a villain to consumers who wanted more value.

Maslow, Smith, and Friedman are all famous for their inputs into economic and behavioural theory. They’ve won Nobels. Schools have buildings named after them.

Friedman only looked at the flow of money.

He wants you to care for the customer so you can put more money in your bank account.

He thinks maximizing employee output while minimizing turnover will keep costs down and profits up.

You enter a dark cave when you think like Friedman.

An opportunity to save money today overshadows an opportunity to make money tomorrow.

Maximizing shareholder value by making money today is a short-term view.

The stock market is filled with Friedmans who only think short-term.

Jack Welch worshipped Friedman.

Bob Lutz did not. He wrote a fantastic book called “Car guys vs Bean Counters – The Battle for the Soul of American business”.

That’s exactly where Friedman missed out. He was so busy counting the money for shareholders he lost sight of the soul of the enterprise.

When we bought our first restaurant, there was so much I didn’t know.

I did a lot of things that lowered shareholder value. But since the shareholders were just me and Aline, it didn’t matter.

We cared for the customer, and we wanted to have a profitable business – in that order.

The first Christmas, we took 20% of the profits and bonused the employees with profit sharing.

We matched employee donations dollar for dollar. We gave $2000 in gifts to a family of nine at Christmas.

We sponsored a teenage outreach centre with $5000 to help with needed renovations at their facility.

We decorated the restaurant for every holiday.

Halloween was the craziest. It took two days to complete.

We had two parties a year – one at Christmas and one in July.

The parties cost the company about $5000 every year – about 10% of total profits.

We made money. We helped our community. It felt good.

On the way to happy-ville, I worked with Friedman’s stunt double.

He was a restaurant developer for the franchise.

He questioned profit margins.

He wondered why we gave so much to people without “loyalty” or no way to repay our generosity.

Early on, I didn’t pay much attention to Friedman’s twin.

I have to admit, the frigid air cooled my sense of generosity over time.

One day, Friedman accused me of not maximizing his shareholder value.

It upset me.

I wanted to quit everything.

We worked 3 years to grow sales to develop a high-functioning team.

I had taken no vacations, no sick time, and no personal days.

I worked six days a week and spent more time at work than I did with my family.

I’m terrible at concealing my frustration.

Reading me like a pamphlet, Friedman asked, “If you’re so upset with us, why do you want to invest in a second location?”

My next words spoke truth.

Without thought, in total anger, I blurted, “Because this business makes money. And I like money.”

Friedman had drawn me into his selfish act of maximizing shareholder wealth.

I remember exactly where I was when I said those words.

It was the proverbial fork in the road, and I had already chosen the path.

I still cared about the customer and wanted to create customer value.

I cared more about my bank account and creating bank account value.

It was so slight a shift I didn’t recognize it.

I continued down Friedman’s path for another 16 months until I realized it was time to remove the biggest problem – ME.

By that point, we had the second location.

We listed the businesses and continued to run them as profit machines until a buyer saved us from ourselves.

I stopped thinking about long-term customer value when I chose short-term shareholder value.

It was a tough lesson to accept.

That sassy Friedman tricked me.

I meet business owners each week who want to make money.

They ask their advertising to bring more customers.

Friedman likes advertising that makes money NOW.

He wouldn’t agree with anything I do now.

It’s too long-term for him.

Friedman doesn’t care for dreaming. It’s abstract and unmeasurable.

He will spit coronavirus on your right brain.

Nobel or not, I don’t like him.

He took advantage of me once.

You will become the biggest problem in your business if you think like a Friedman.

So please be careful.

The path is dangerous and full of problems your advertising will never be able to fix.

- Pretend is bad for business - July 9, 2024

- Curiosity is Creativity’s Roommate - February 10, 2023

- Labels are tattoos on your brain - December 15, 2022